How to Become an MLO

Overview

All individuals desiring to originate residential mortgage loans must, at the very least, be registered through the Nationwide Mortgage Licensing System and Registry (NMLS). The NMLS is the federal agency responsible for overseeing and, in cases where a license is required, tracking the licensing of residential mortgage loan originators (MLOs) operating throughout the United States and its possessions along with the companies that sponsor them.

If an individual ultimately originates residential mortgage loans for an entity exempt from licensure (i.e. a depository institution regulated by a federal banking regulator or the Farm Credit Administration [FCA]), he or she must be registered through the NMLS but is personally exempt from licensure. If, however, an individual desires to seek sponsorship (employment) through a non-depository entity, he or she must secure a Mortgage Loan Originator license in addition to registering through the NMLS.

MLO licenses are issued by each state or U.S. possession. For a non-exempt mortgage loan originator to originate residential mortgage loans securing properties located within a particular state or U.S. possession, he or she must possess a valid MLO license that was issued by that state or U.S. possession. For example, if a non-exempt MLO resides in Connecticut, is sponsored by a non-exempt lender located in Idaho, and desires to originate a residential mortgage loan securing a property located in South Carolina, that MLO would have to be licensed as an MLO by the state of South Carolina. Without having been issued any other state’s license, that MLO would only be permitted to originate mortgage loans securing properties located in South Carolina.

The following seven steps will ease you through the process of getting your MLO license:

Before doing anything else, the future residential mortgage loan originator needs to create their free NMLS account through the Nationwide Mortgage Licensing System’s website (THE LINK FOR WHICH IS PROVIDED AT THE END OF THIS SECTION).

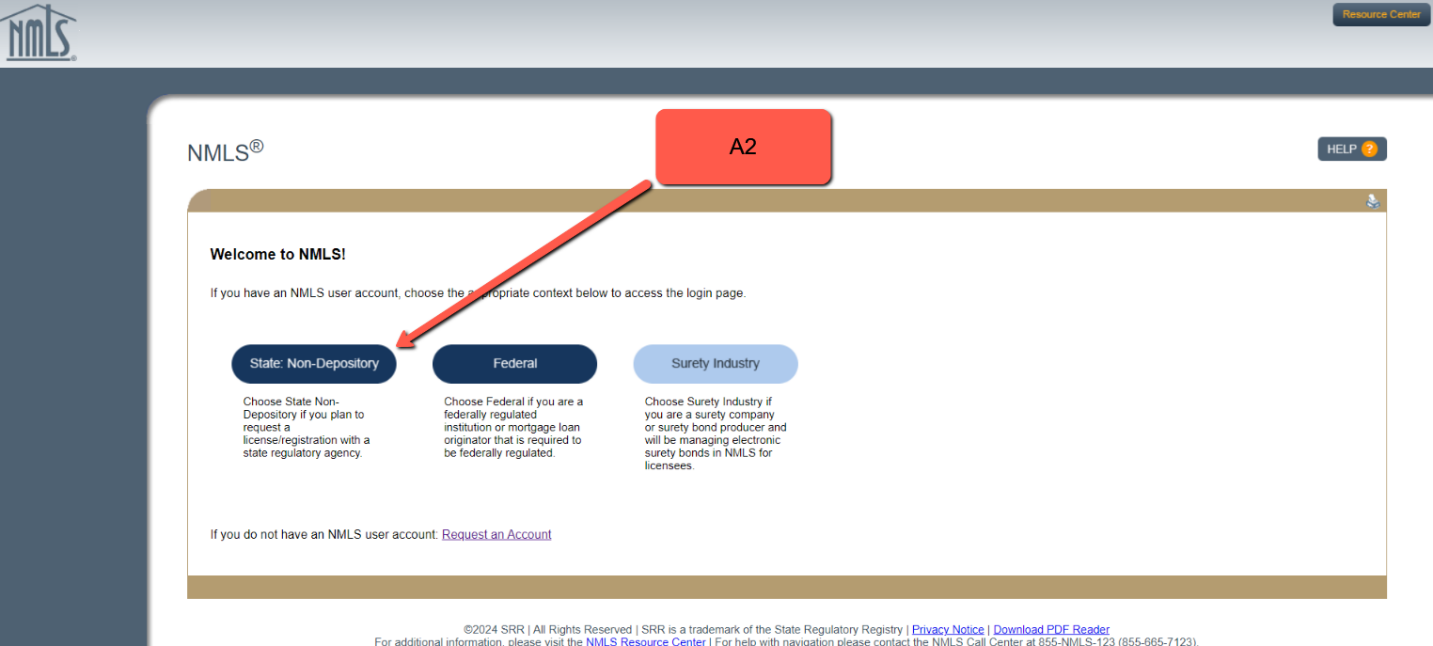

Once on the NMLS’ website:

Step 1A is to click on the Getting Started Licensed Individuals button.

Step 1A1 is to scroll down.

Step 1A2 is to click on NMLS.

Step 1B requires you to click on the “Request an Account” link.

Step 1C involves selecting the “Individual” option.

Step 1D, requires you to prove that you’re a human being by entering the characters as they appear (A) after which you will need to click on “Next” (B).

Step 1E requires the completion of all of the requested information after which you will click “Next” at the bottom.

Step 1F requires you to confirm the accuracy of what you entered on the previous page.

Once you’ve provided and confirmed the accuracy all required information, the system will create your NMLS account and issue you your NMLS number (a.k.a. unique identifier). Be certain to save this critically-important number because your unique identifier connects you to everything that you will do throughout your mortgage career.

When is Registering All That I’m Required to Do?

If your intention is to originate mortgages for an exempt entity, this is all that you will need to do since you will not be required to secure an MLO license. Congratulations! You’re done!

If, however, you’re an individual for whom a license is ultimately required, please continue.

Oh, and I almost forgot! The NMLS’ website may be reached here.

Critical Note: Any individual not desiring to pursue mortgage loan origination but who, instead, intends to operate as a contract (1099) mortgage processor or contract (1099) mortgage underwriter, must be licensed as a residential mortgage loan originator through each state or U.S. possession in which the properties on which he or she ultimately processes or underwrites are located.

All candidates for mortgage loan originator licensure must successfully complete an NMLS-approved, 20-hour national pre-licensing education (PE) course. We enthusiastically encourage you to register for and complete your online 20-hour PE course through OnlineEd (#1400327), the premier NMLS-approved education provider (save 10% off of the already-low registration fee by using coupon code success10 when registering through the AxSellerated Development website).

To register for your required online 20-hour national pre-licensing education course and save 10%:

Step 2A – Access the AxSellerated Development website here.

and then proceed to the pre-licensing education section.

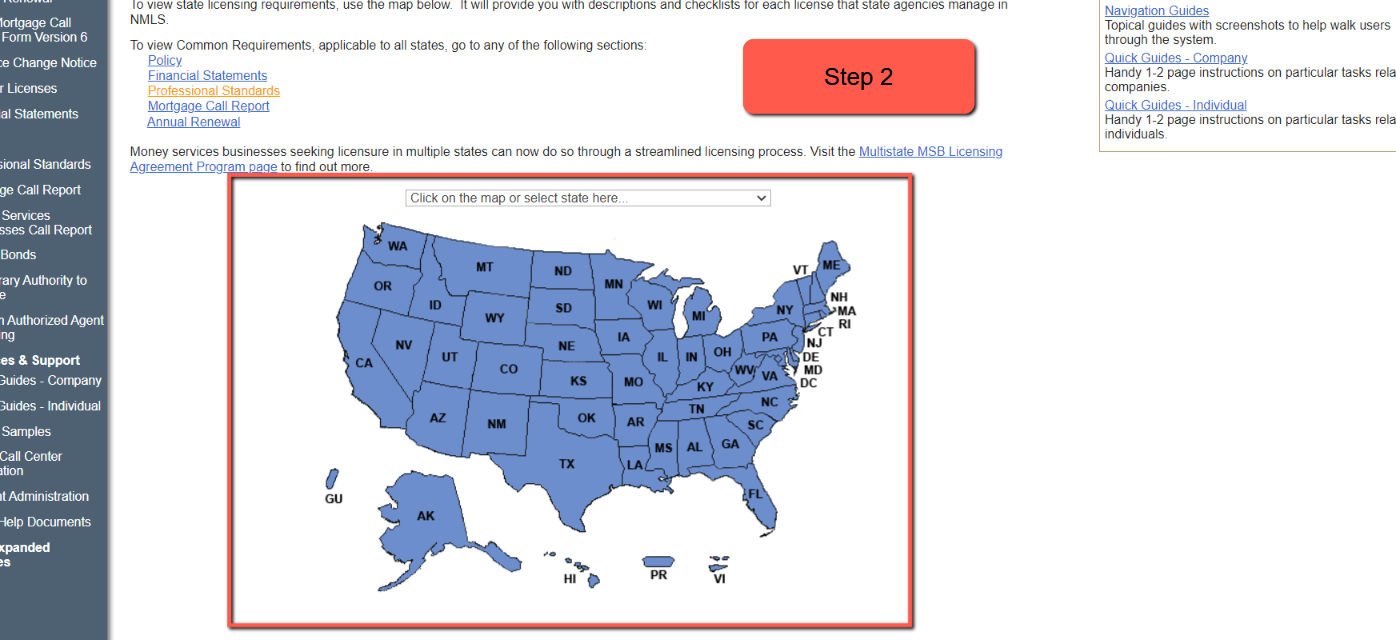

Step 2B – After landing on this page, scroll down to the U.S. map.

Step 2C – Select the primary state through which you will initially seek licensure. Licensure through additional states will be addressed in a later section.

Critical Note: The 20-hour pre-licensing course covers all states and need only to be taken once.

Step 2D – After landing on the page for your applicable state, scroll down until you locate the course:

Step 2E – The first course at which you arrive is the 20-hour course that also contains any state-specific education that may be required by the state in which you are primarily seeking licensure. Add the course to your cart, check out, and begin.

Courses start daily and you can choose the course start date that works best for you.

Step 2F – Complete your 20-hour course.

Critical Note: The NMLS requires that you complete your 20-hour course within 14 days from the date that you begin it. The NMLS strictly prohibits extensions beyond this fourteen-day timeframe. Be certain, therefore, to begin the course right away because you must complete it within the 14-day allotted timeframe in order to pass and receive credit for it.

OnlineEd will automatically notify the NMLS of this requirement’s satisfaction within 72 business hours from when you’ve successfully completed the 20-hour pre-licensing course.

Critical Note: If your 20-hour course includes a state-specific pre-licensing education component that’s required by that particular state, please refrain from completing the state-specific component until you’ve taken and passed the NMLS exam.

The NMLS exam does not test on state-specific material. There is no need to convolute what you need to learn for the NMLS exam with state-specific material on which you will not be tested.

Pass the NMLS exam and then complete your state-specific pre-licensing education.

You’ll have access to it for one year from your date of purchase.

All residential mortgage loan originator licensing candidates must take and pass the 120-question, multiple-choice, national mortgage licensing examination in order to qualify for licensure. Although your 20-hour national PE course will help to prepare you for this exam, in order to pass it, you must study above and beyond your 20-hour course and ultimately master:

The Four Strategies for NMLS Exam Success

Wait!

Done studying? Before scheduling your NMLS exam, why not gauge your readiness by undergoing an AxSellerated Development NMLS Exam Readiness Assessment?

We’re confident you’d agree that the AxSellerated Development Readiness Assessment’s $25 cost is unquestionably worth not having to wait the thirty days you’d be required to wait in order to retake the NMLS exam if your test results are disappointing.

AxSellerated Development’s Readiness Assessment is performed through a one-half-hour, one-on-one, live virtual interview with one of our seasoned NMLS exam prep instructors. The Readiness Assessment consists of a series of exercises strategically structured to assess your readiness to sit for and your current likelihood of passing the NMLS exam.

After completing your Readiness Assessment, your assessor will send you a detailed statistical analysis of the assessment’s findings to help you decide whether or not more preparation is needed.

If you ultimately decide to continue preparing, the Readiness Assessment’s $25 cost will be credited towards the cost of any one-on-one tutoring that you may elect to pursue through AxSellerated Development.

To order your AxSellerated Development NMLS Readiness Assessment:

Step 1 – Click on the button below.

Step 2 – Scroll down slightly.

Step 3 – Access, read, complete, and submit the NMLS READINESS ASSESSMENT AGREEMENT.

Step 4 – Purchase the Readiness Assessment.

Step 5 – Add the Readiness Assessment to your cart.

Step 6 – View your cart.

Step 7 – Checkout.

Step 8 – Login if you’re already a customer or register if this is your first visit (please remember to retain and safeguard your username and password).

Step 9 – Access your shopping cart.

Step 10 – Proceed to checkout.

Step 11 – Scroll down, enter all of your personal details, enter your method of payment, acknowledge that you have read and understand the terms and conditions, and place your order.

Step 12 – Await to be contacted. An AxSellerated Development representative will e-mail you within 24 hours to schedule your NMLS Exam Readiness Assessment.

Critical Note: Regardless of which modality you choose, be certain to thoroughly read everything you’re sent in response to your exam registration, especially if you opt to take it online.

Before you’re permitted to schedule your NMLS exam, you must pay for it and accept the NMLS’ Candidate Agreement. To do this:

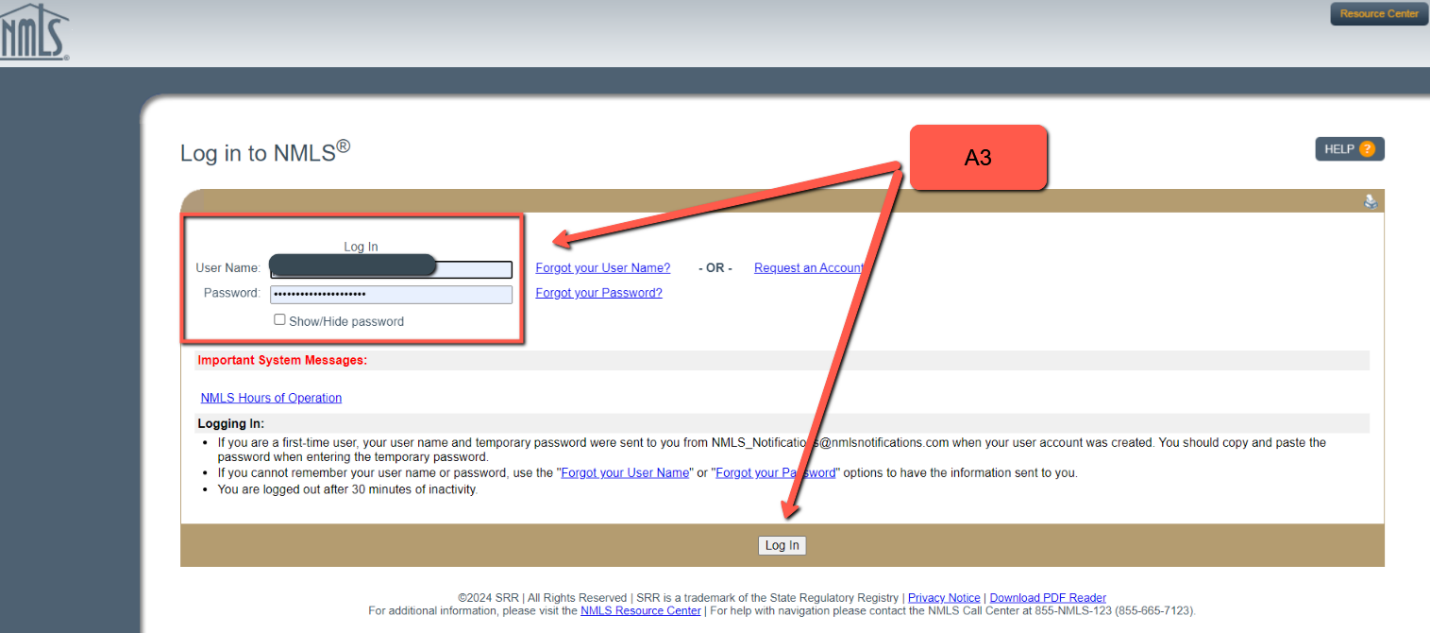

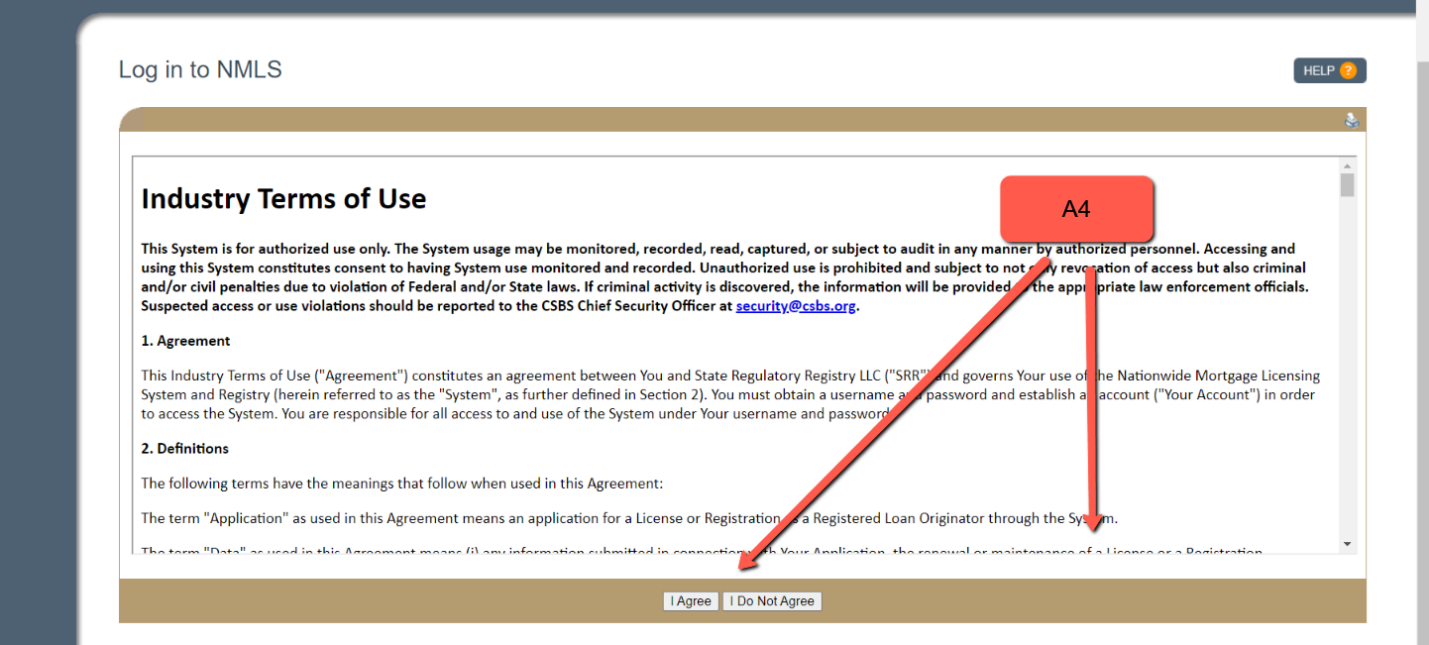

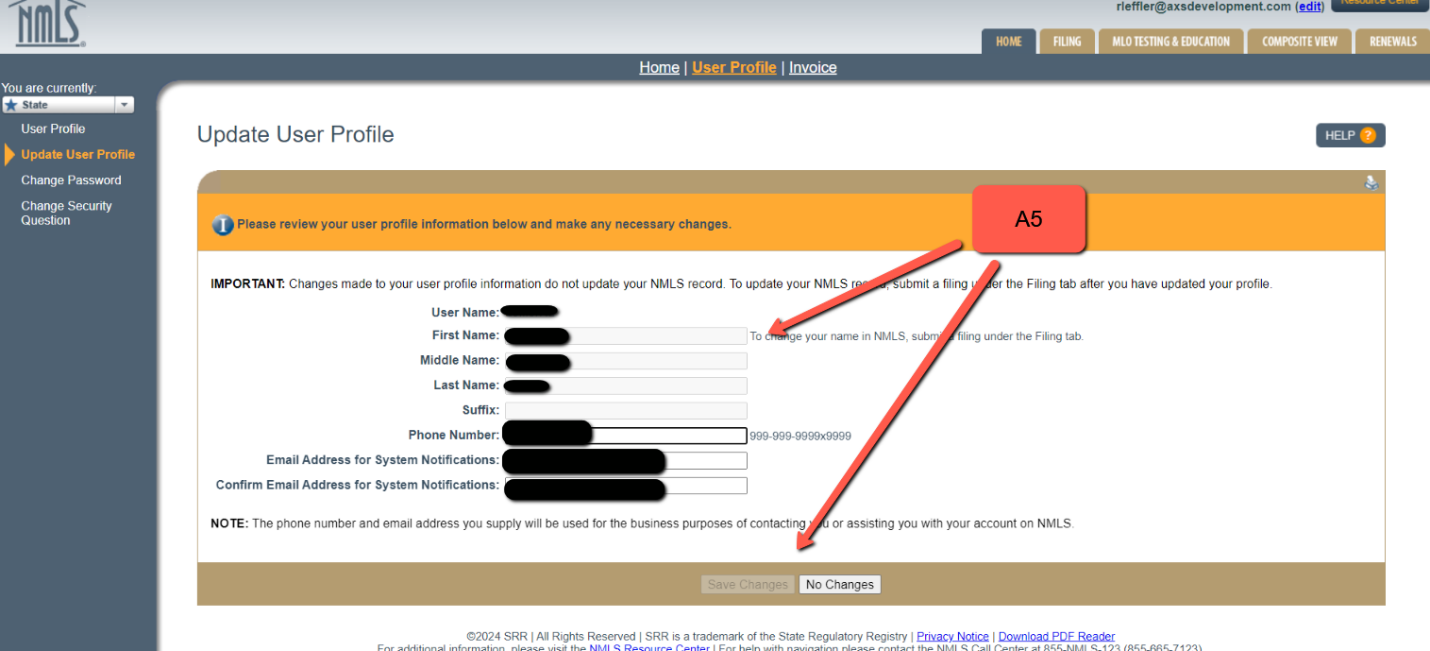

A. Log into your NMLS account.

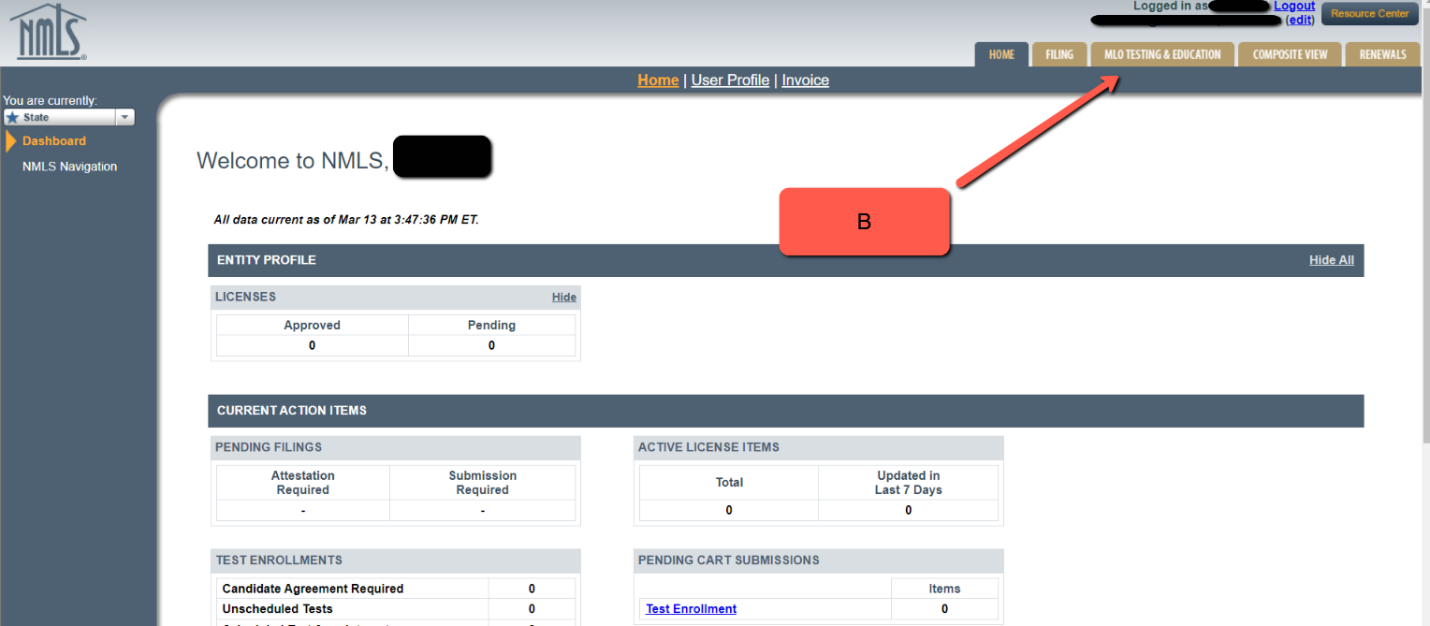

B. Click on the “MLO Testing & Education” tab.

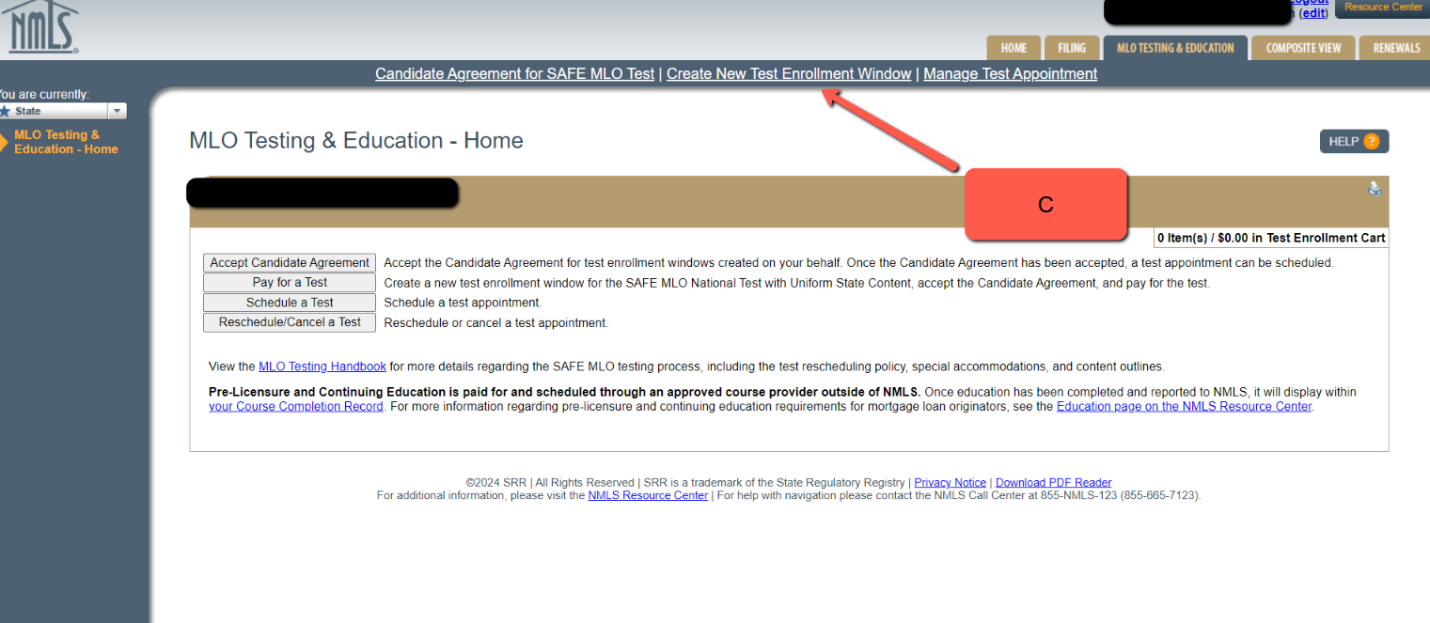

C. Click on the “Create New Test Enrollment Window” link.

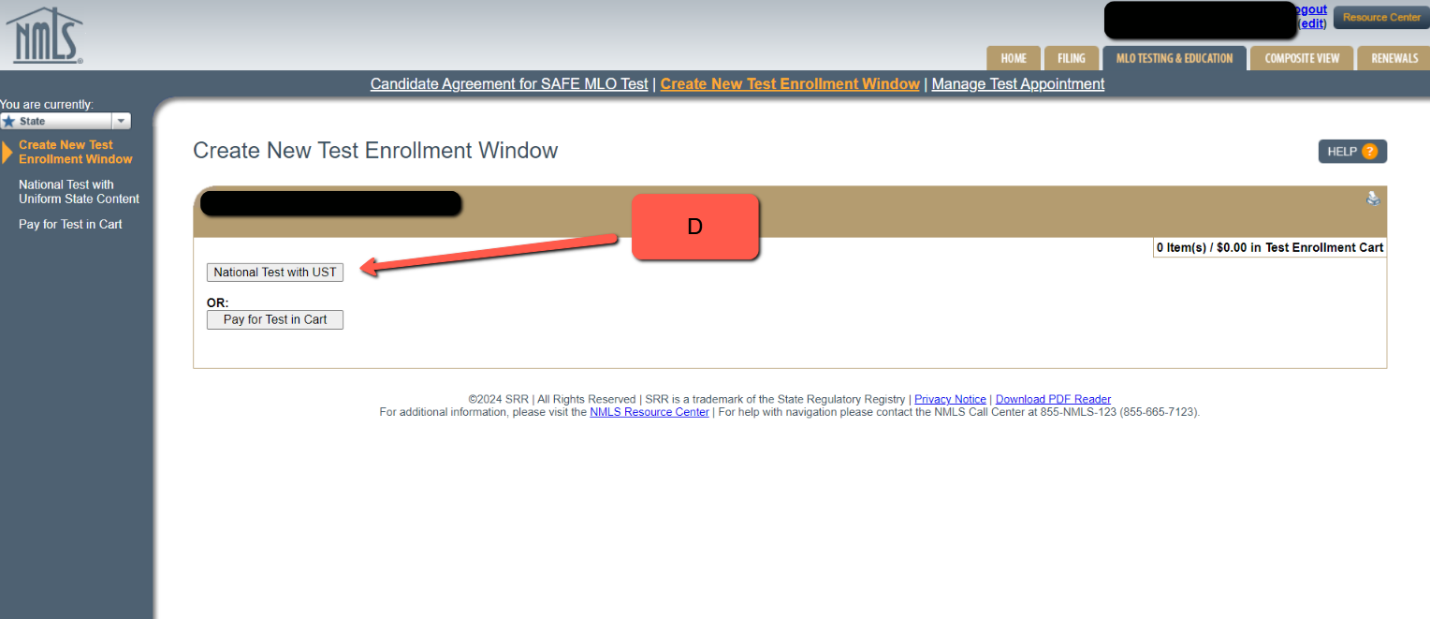

D. Click on the “National Test with Uniform State Content” button.

E. Select the “SAFE Mortgage Loan Originator Test – National Component”.

F. Click the “Add to Cart” link.

G. Click the “Proceed to Candidate Agreement” button.

H. Review the Candidate Agreement and click the “I Accept” button.

I.Click the “Pay Invoice” button to pay the exam registration fee.

Once you’ve completed these steps, you may schedule your exam by:

- Logging into your NMLS account;

- Clicking the “MLO Testing and Education” tab;

- Clicking the “Manage Test Appointments” link on the submenu;

- Clicking either the “Schedule – Test Center” or the “Schedule – Online Test” button; and

- Completing your registration by following Prometric’s prompts.

Critical Note: Once your exam day arrives, you will have slightly over three hours to complete its 120 multiple-choice questions. You must score a grade of 75% or higher to pass.

As previously discussed, mortgage Loan Originators who are required to be licensed must be so through each U.S. state or possession in which the properties on which they originate residential mortgage loans are located.

Some states require MLO licensing candidates to complete NMLS-approved state-specific pre-licensing education, in addition to the 20-hour national pre-licensing course.

Critical Note: The 20-hour national PE course need only be successfully completed once.

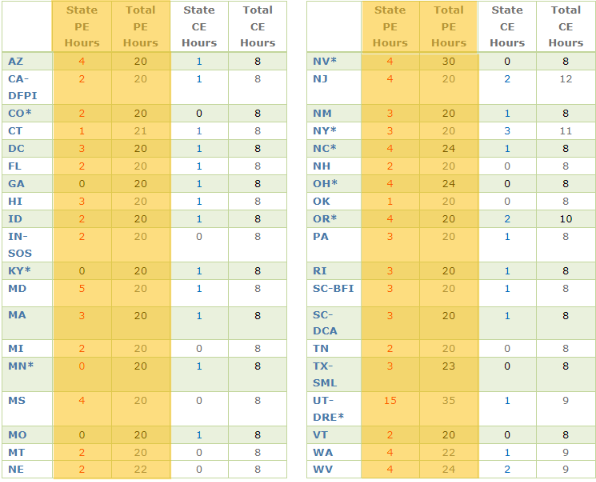

The following chart depicts the states that require state-specific pre-licensing education in addition to the 20-hour pre-licensing course. As previously mentioned, the 20-hour pre-licensing course that you completed may already have included a state-specific component:

If any of the state(s) in which you intend to seek licensure require state-specific pre-licensing education, the following are the steps you’ll need to take in order to satisfy that requirement.

Critical Note: If you’re only seeking licensure in one state and that state happens to require state-specific pre-licensing education, your 20-hour course likely included that training. Please confirm prior to unnecessarily purchasing a course that may have been included with your original 20-hour PE registration. This step only applies to additional states requiring state-specific pre-licensing education through which you will also be seeking licensure.

Register for your state-specific pre-licensing education by completing the following steps:

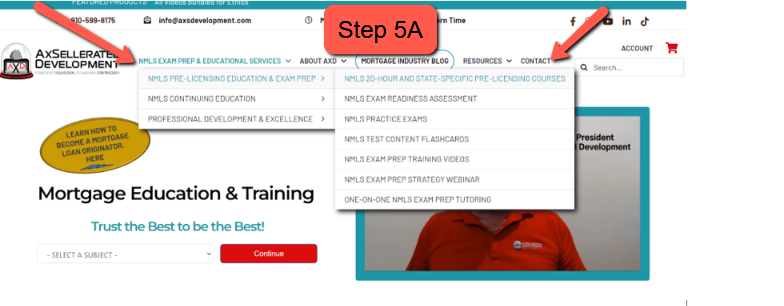

Step 5A – Access the AxSellerated Development website here.

and then proceed to the pre-licensing education section.

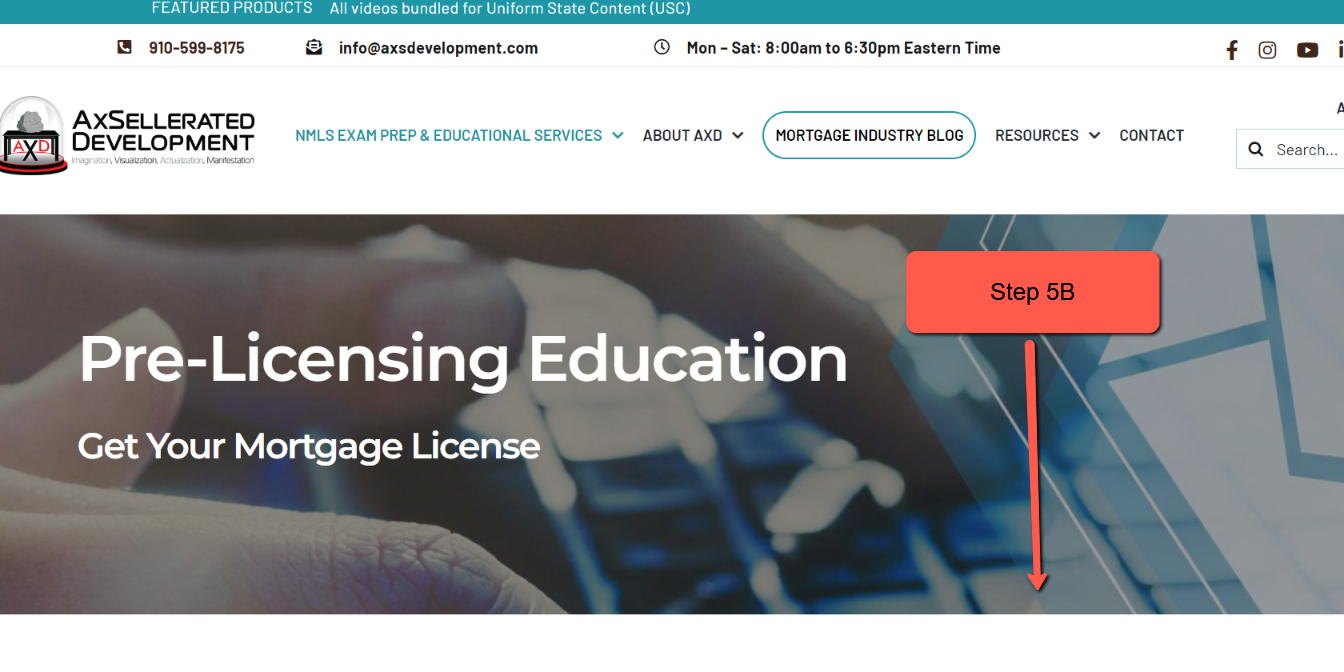

Step 5B – Scroll down to the U.S. map.

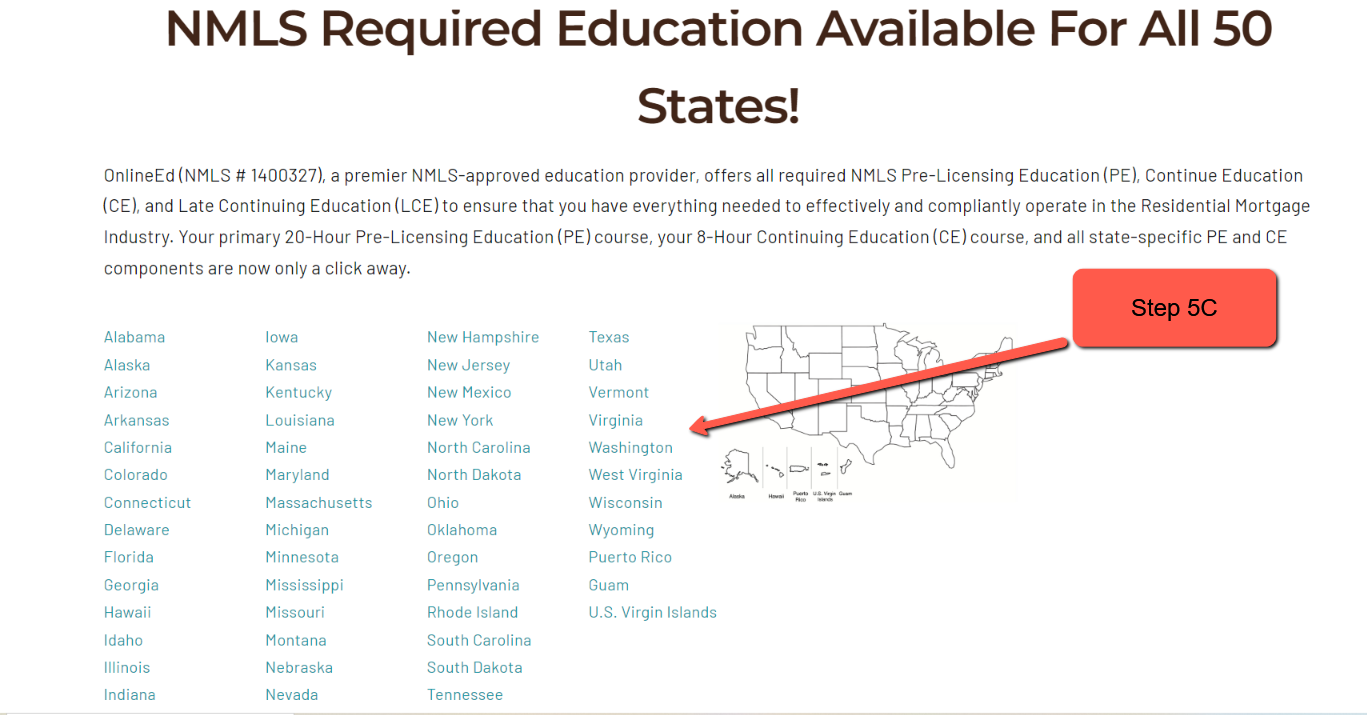

Step 5C – Select the state in which you are seeking state-specific pre-licensing education.

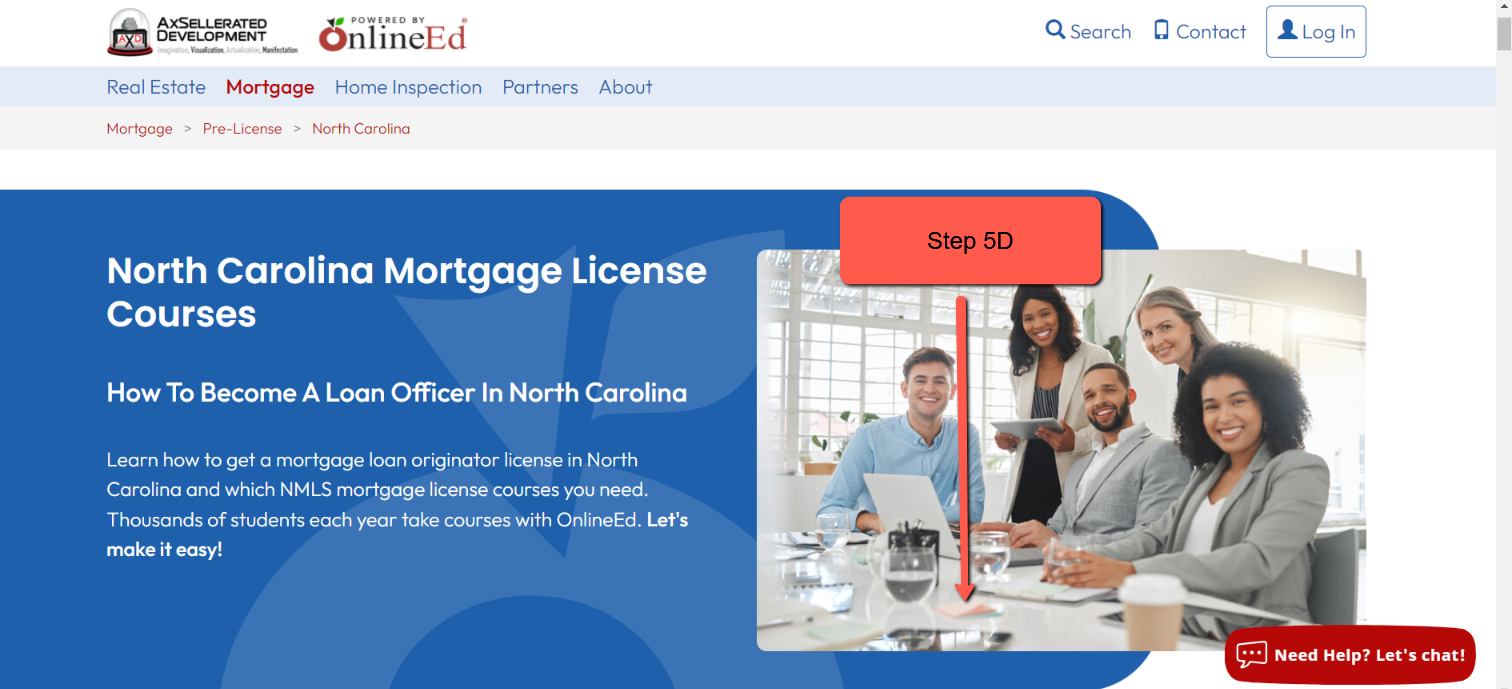

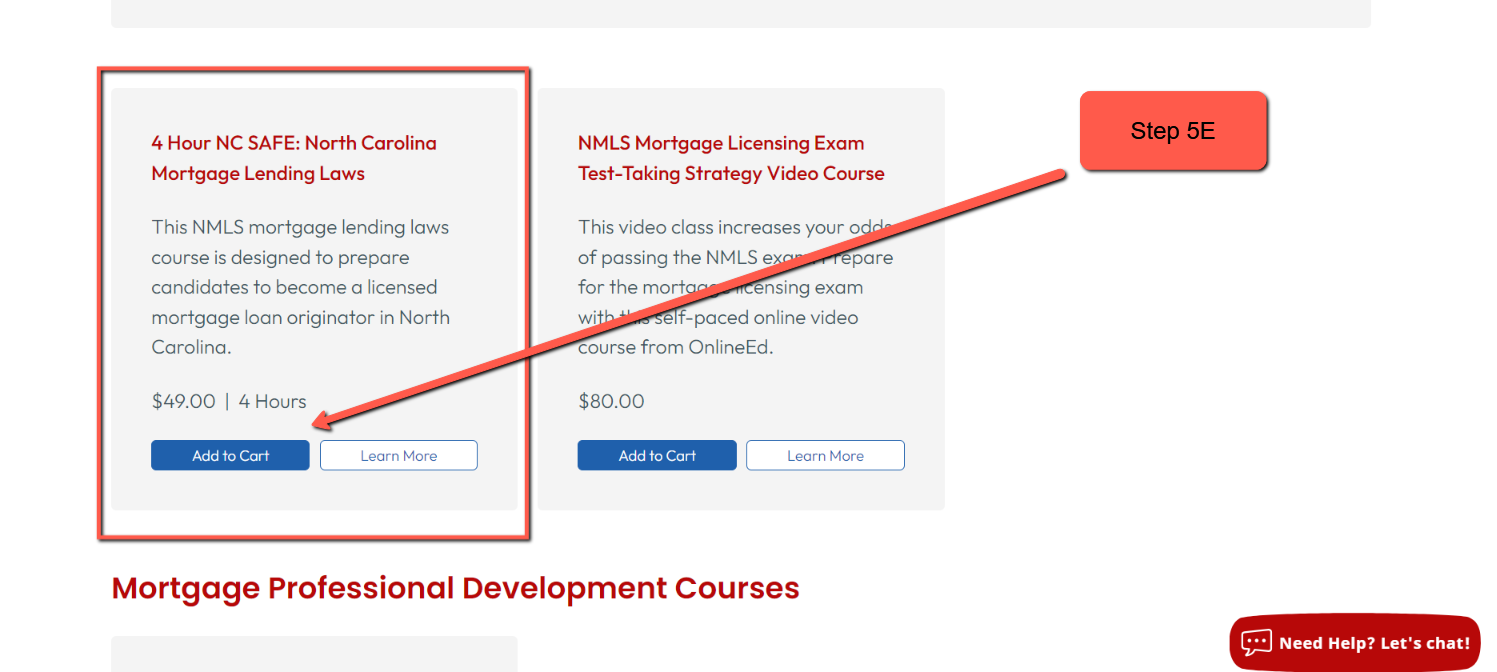

Step 5D – Scroll down to the state-specific course.

Step 5E – Register for the course.

Step 5F – Complete the course.

Critical Note: Remember to complete state-specific education only after you have taken and passed the NMLS exam. By following this advice, you won’t overwhelm yourself with state-specific material on which the NMLS exam will not be testing you while you’re actively preparing for that exam. Your state-specific course(s) will be available to you for up to one year from its date of purchase.

OnlineEd will automatically notify the NMLS of this requirement’s satisfaction within 72 business hours from when you’ve successfully completed your state-specific course(s).

Finding a sponsor means securing employment through a licensed mortgage lender or broker. Take your time and explore your options. The keys to finding your ideal sponsor are creativity and flexibility. The more creative and flexible you are, the easier it will be for you to locate an employer willing to take a chance on you.

The number one piece of advice that we can offer the new loan originator who is seeking sponsorship is to find a sponsor that provides a formal and thorough training and mentorship program. Any potential employer that does not offer a thorough training program, a part of which includes the opportunity to shadow an experienced MLO, is an employer who you might want to avoid. Could you imagine a police officer graduating from the police academy and being directed to patrol solo on his or her first day? That would, unquestionably, prove disastrous! Just as the rookie police officer requires extensive on-the-job training, so does the rookie loan originator.

Although you will not be allowed to originate loans for your new sponsor until you are issued your license(s), in order to be issued an active license you will need to be actively sponsored.

Reality dictates that the new mortgage loan originator will likely face more challenges in finding employment than would a seasoned mortgage professional. But everyone has to begin somewhere, right? Luckily, there are many mortgage lenders and brokerages willing to take a chance by hiring someone who is new to the industry. By hiring someone new, they can train him or her to their processes and procedures without having to first deprogram and then reprogram their new hire.

Important points to remember when seeking your first MLO position are preparation, flexibility, perseverance, and creativity.

Preparation

We cannot emphasize, strongly enough, the importance of being meticulous. In the wise words of Will Rogers, “You never get a second chance to make a first impression.”

When this company receives a resume, for example, the first thing that the recruiter does is to scan it for typos, grammatical mistakes, slang, and other errors. If we find anything of the sort, that resume immediately makes its way to the shredder. Why? Because if someone neglects to present his or her own best professional impression with something as important as seeking a job, what is the likelihood that he or she will appropriately and professionally represent our company?

One worthy suggestion is to engage a professional resume writer (a human being, not artificial intelligence) to thoroughly scrutinize your credentials prior to you using them. If doing so is not an option, be certain to request a review from no less than three other people.

Lots of other helpful tips and strategies to come!

Flexibility

The more flexible you are, the easier it will be for a prospective employer to say, “you’re hired!” Being able to relocate to where the company operates can certainly tip the cards in your favor. Of course, not everyone is readily able to pick up and move therefore, if that’s not possible, consider offering flexibility in the days and times when you will be available to work. If you’re unable to relocate, perhaps you might be willing to assume responsibility for a larger geographic territory in the state in which you currently live.

Perseverance

Whether it’s selling a loan or pursuing a job, every “no” that you receive brings you one step closer to that coveted, “yes.” Make that your mantra! Do not allow disappointment to discourage you to the point of giving up.

In structuring your job search, commit to reaching out to no fewer than ten potential employers every day. But that does not mean e-mailing countless resumes. When you generically e-mail your resume to a company’s human resources department, it’s likely to find itself, along with the dozens of other resumes received that day, in someone’s rarely-accessed file folder.

You must creatively stand apart from your competition. Try visiting the company’s offices in person. Do your research and come up with a unique way to connect with someone already working for that company. Identify and creatively reach out to the company’s decision makers.

AxSellerated Development has lots of other exciting and creative strategies to offer. Stay tuned!

Creativity is Key

You’re likely not the only person to be interviewing with a prospective lender or brokerage for sponsorship. And each sponsor can only hire a limited number of loan originators. How can you, therefore, set yourself apart from your competition?

One of the most common mistakes that job candidates frequently commit when asked why they’re interested in working for a particular organization is to praise the company, share what they’ve learned about the company, and generically promote their own strengths.

Remember, everyone being interviewed is telling that interviewer how great they are, how they have the best communication and customer service skills, and how their sales skills are second to none. In reality, most people do little more than “talk the talk.” You need to be the one who “walks the walk.”

What can YOU do for THEM?

Why should they take a chance on you over everyone else eagerly seeking that position? What unique and tangible qualities and benefits do you bring to the table to improve your future employer’s business? Don’t be reluctant to directly ask your interviewer what their specific needs are that you can effectively fulfil?

- Do you have relationships with referral sources? If not, how, specifically, do you plan on developing them?

- What specific actions will you undertake to generate new business?

- How many industry trade shows will you be able to research, attend, and present at annually?

- To what community networking groups do you belong and in which you are active?

- How may first-time home-buyer seminars do you intend to conduct, where will you conduct them, and how do you intend to fill the seats?

These are just a few of the solutions that we encourage you to present to your interviewer at your interview. Remember, specificity and tangible solutions are key.

AxSellerated Development’s Job-Fulfillment Solutions for You

At AxSellerated Development, we thrive on helping new and aspiring mortgage loan professionals achieve success. That’s literally our mission!

We’d love to share additional tips and strategies with you that will help you launch your successful mortgage career.

Order a New Loan Originator Mentoring session through which you will meet with a seasoned mortgage professional eager to provide you with expert tips and guidance, often directly his or her from personal experience, to help you land your ideal entry-level mortgage position. Each New Loan Originator Mentoring Session is a one-hour, live, virtual, one-on-one collaboration after which your mentor will send you a video and audio recording of that session.

To order your AxSellerated Development Mentoring sessions:

Step 1 – Click on the button below:

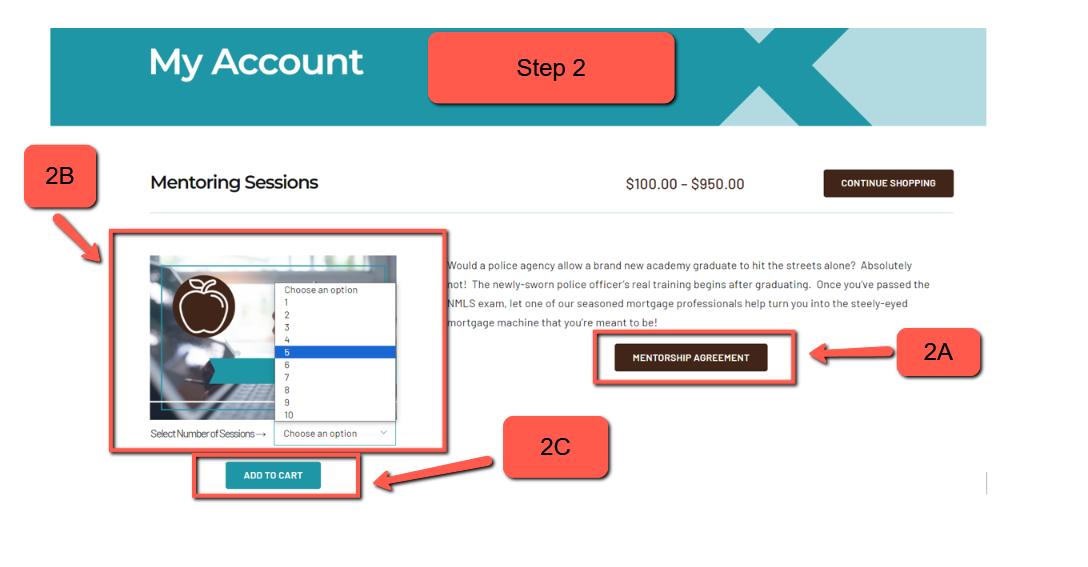

Step 2 – Scroll down, access, read, complete, and submit the MENTORSHIP AGREEMENT (2A), select the number of AxSellerated Development New Loan Originator Mentoring Sessions you would like to complete (2B), and then add it/them to your cart (2C).

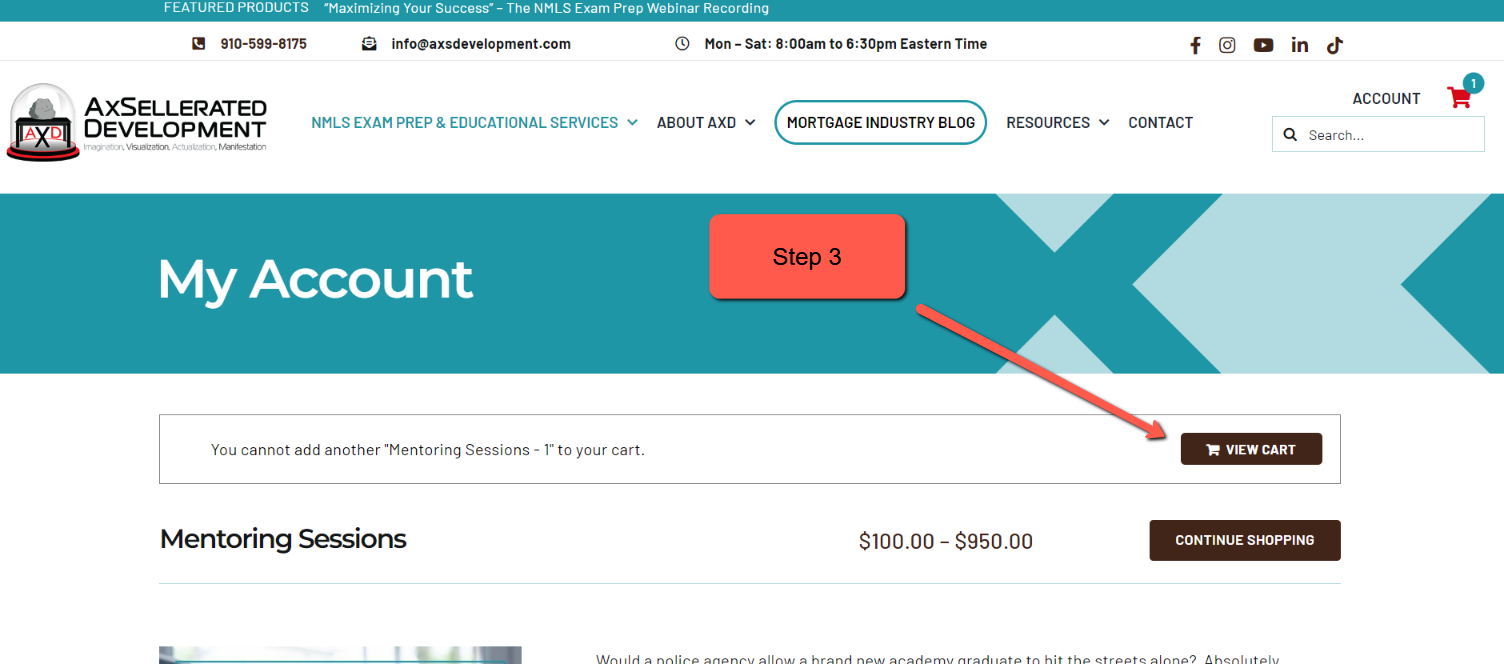

Step 3 – View cart.

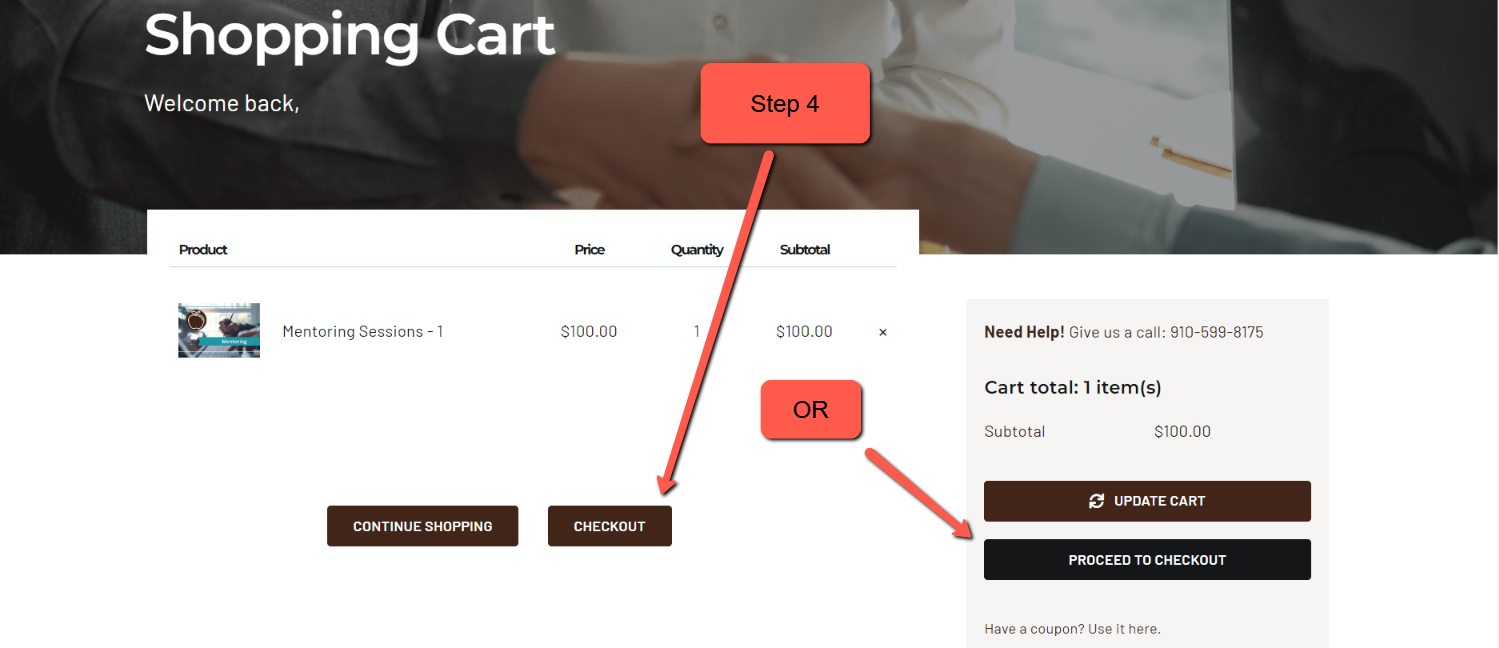

Step 4 – Proceed to checkout.

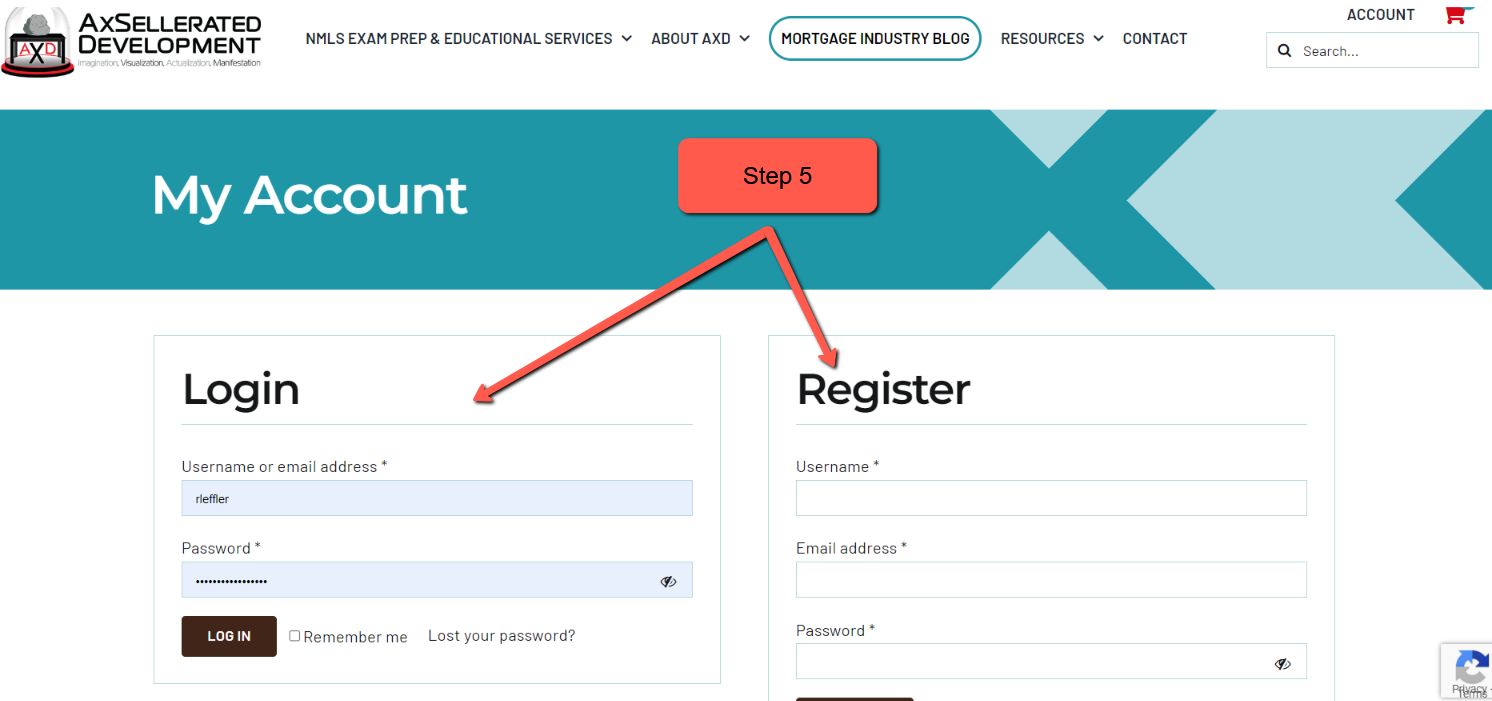

Step 5 – Login if you’re already a customer or register if this is your first visit (please remember to retain and safeguard your username and password).

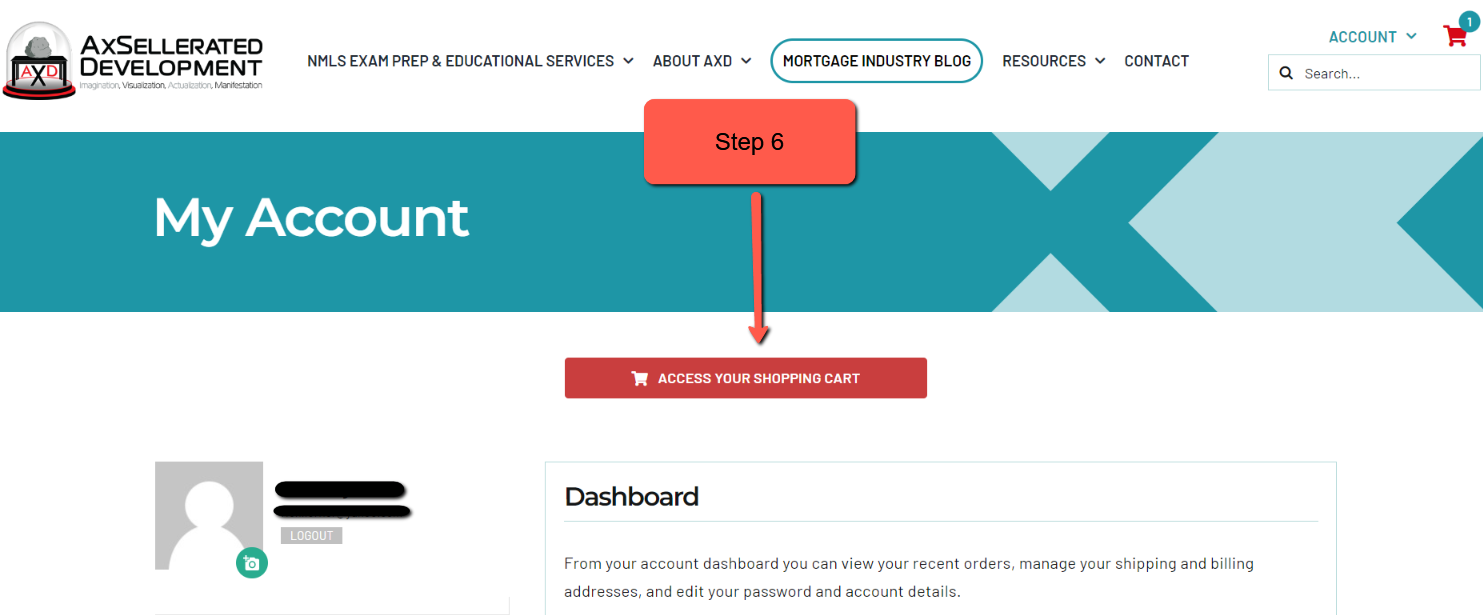

Step 6 – Access your shopping cart.

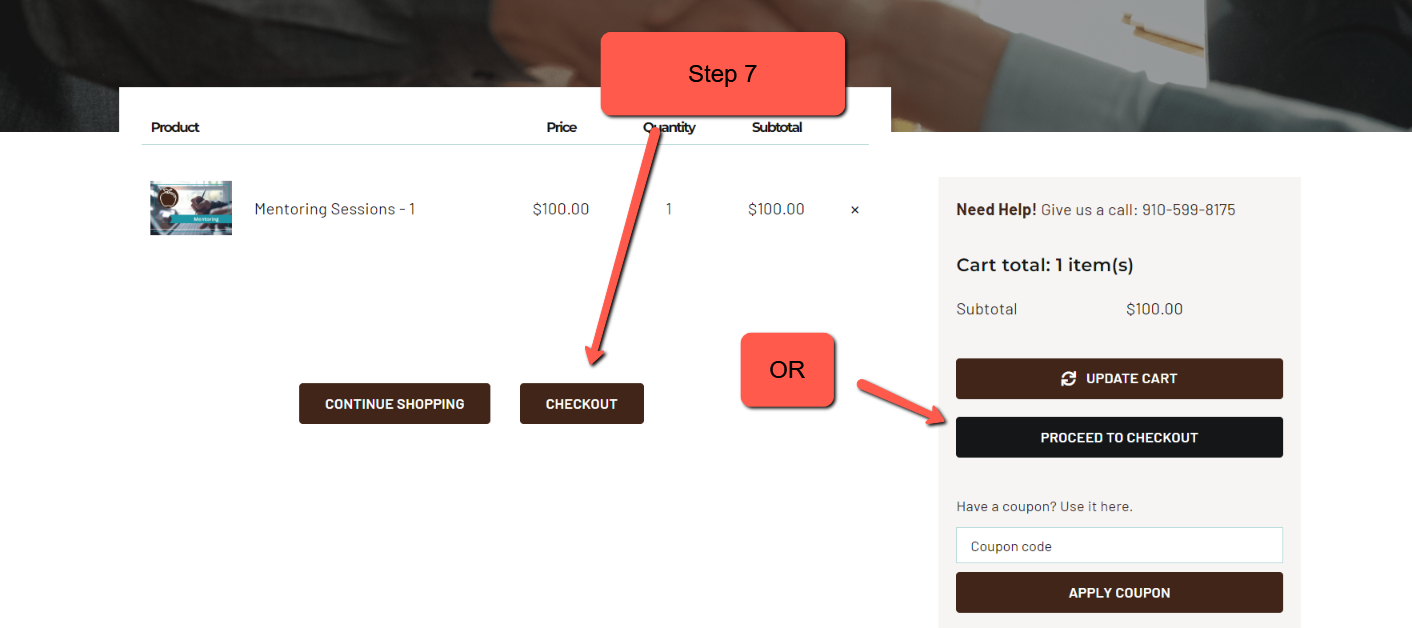

Step 7 – Checkout.

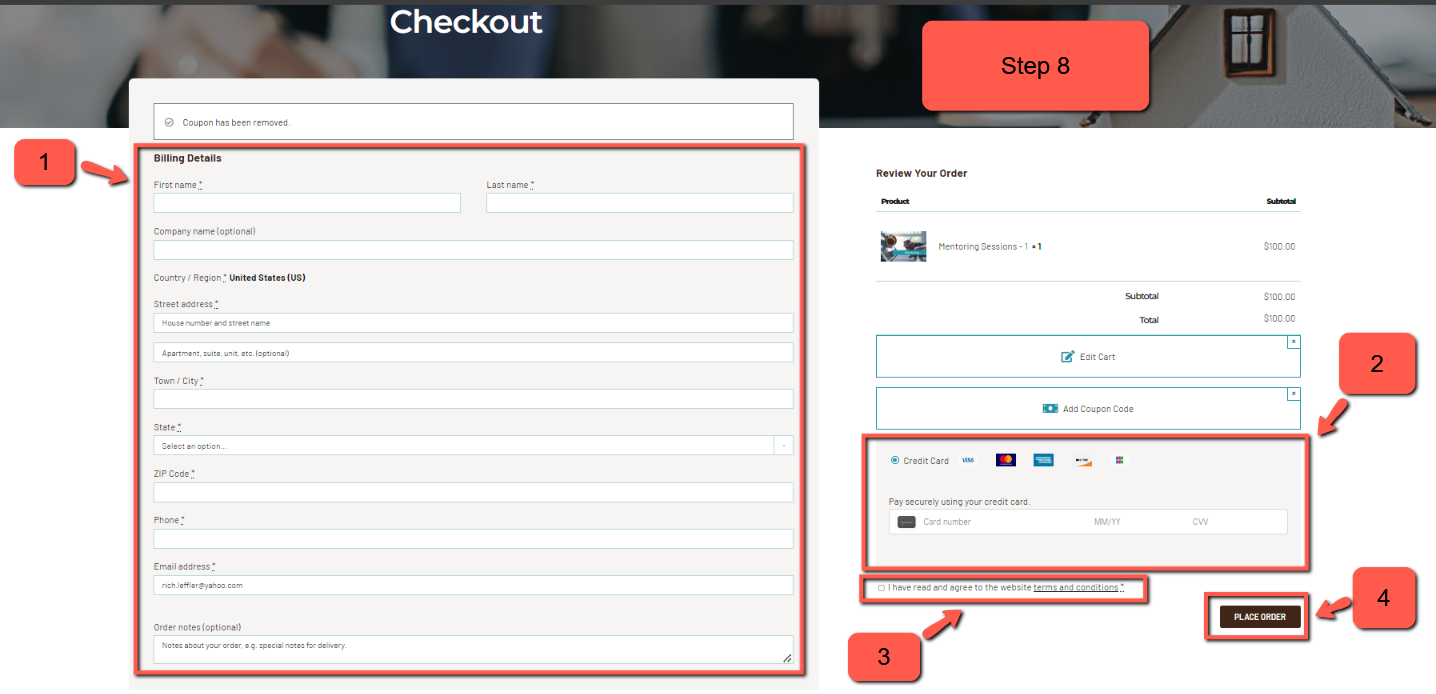

Step 8 – Scroll down, enter all of your personal details, enter your method of payment, acknowledge that you have read and understand the terms and conditions, and place your order.

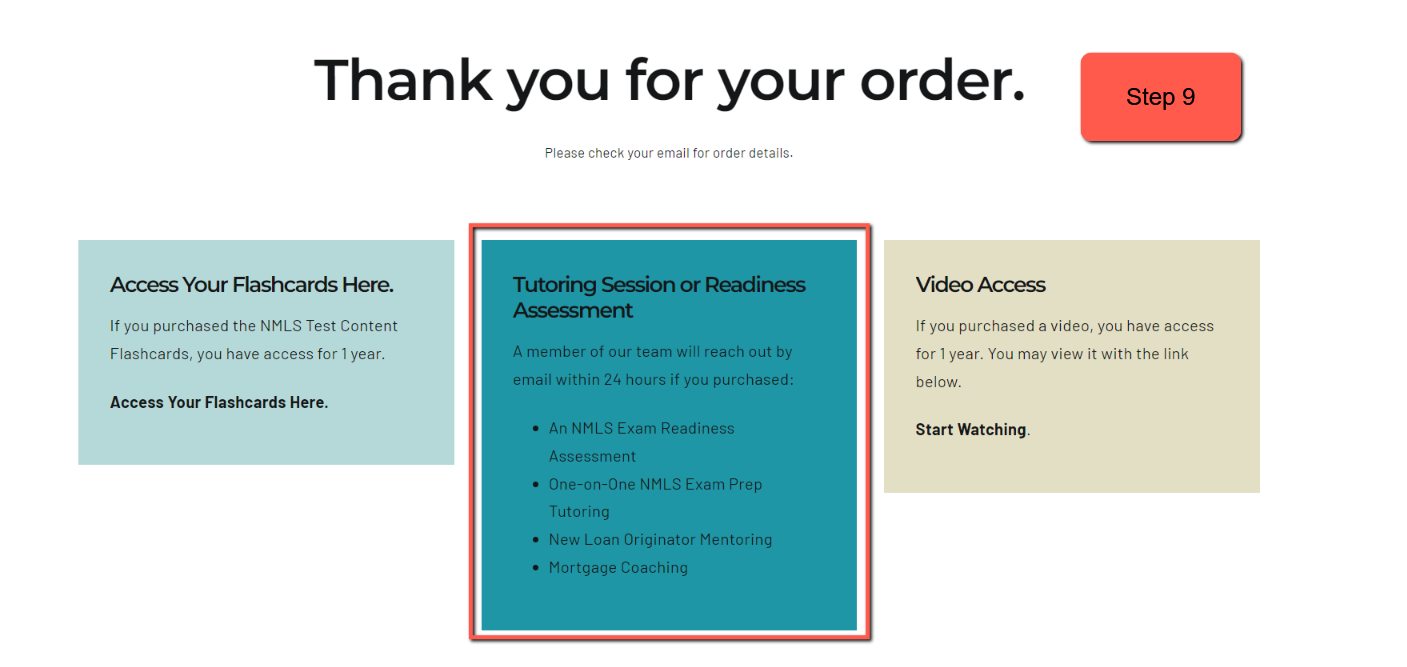

Step 9 – Await to be contacted. An AxSellerated Development representative will e-mail you within 24 hours to schedule your New Loan Originator Mentoring Session(s).

Other job seeking avenues you’re encouraged to explore consist of:

- Utilizing social media, especially:

- Utilizing online job sites, especially:

- Capitalizing on industry job seeking tools such as:

Once you’ve successfully completed all of the aforementioned prerequisites and secured sponsorship (congratulations, by the way), the time has finally arrived for you to apply for your MLO license(s).

All state MLO license applications must be submitted through the NMLS’ website.

To complete the license application process:

Step 1 – Visit the NMLS’ State Licensing Page:

Step 2 – Select the state or U.S. possession in which you desire licensure.

Step 3 – Scroll down to the bottom of that page and look for the requirements checklist and application form for the Individual Mortgage Loan Originator License.

Step 4 – Read the PDF checklist and follow all of the instructions. Be absolutely meticulous when following all directions and procedures to ensure as smooth a licensing application process as possible.

Step 5 – Begin the application process by returning to the NMLS’ website and logging in to your NMLS account.

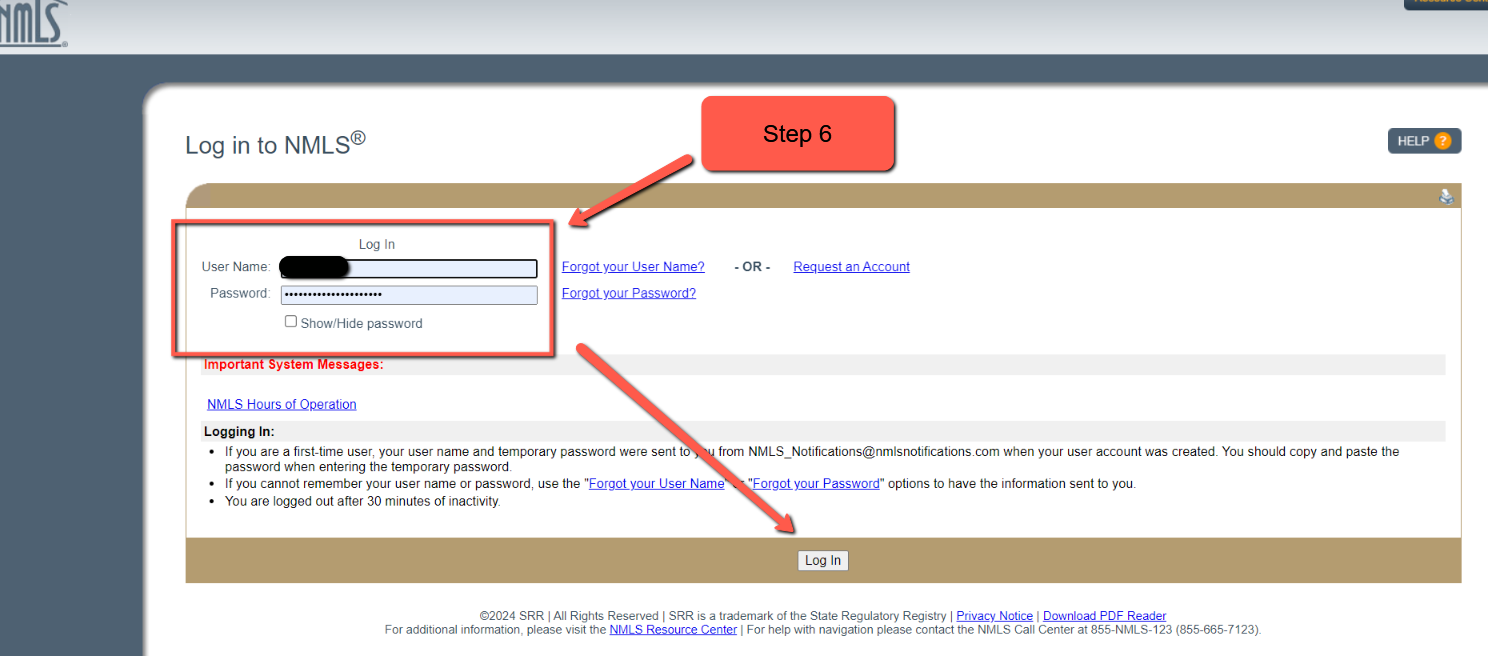

Step 6 – Enter your NMLS User Name and Password.

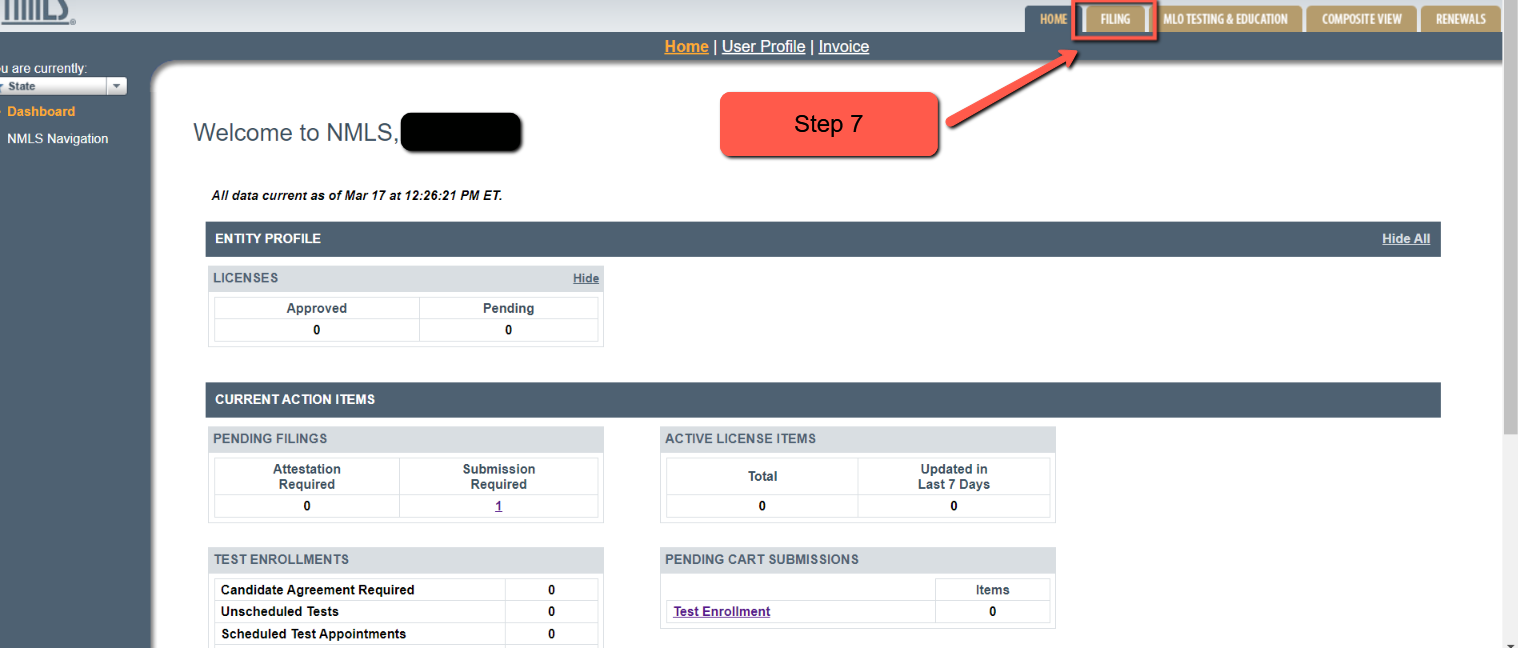

Step 7 – Click on the “FILING” tab.

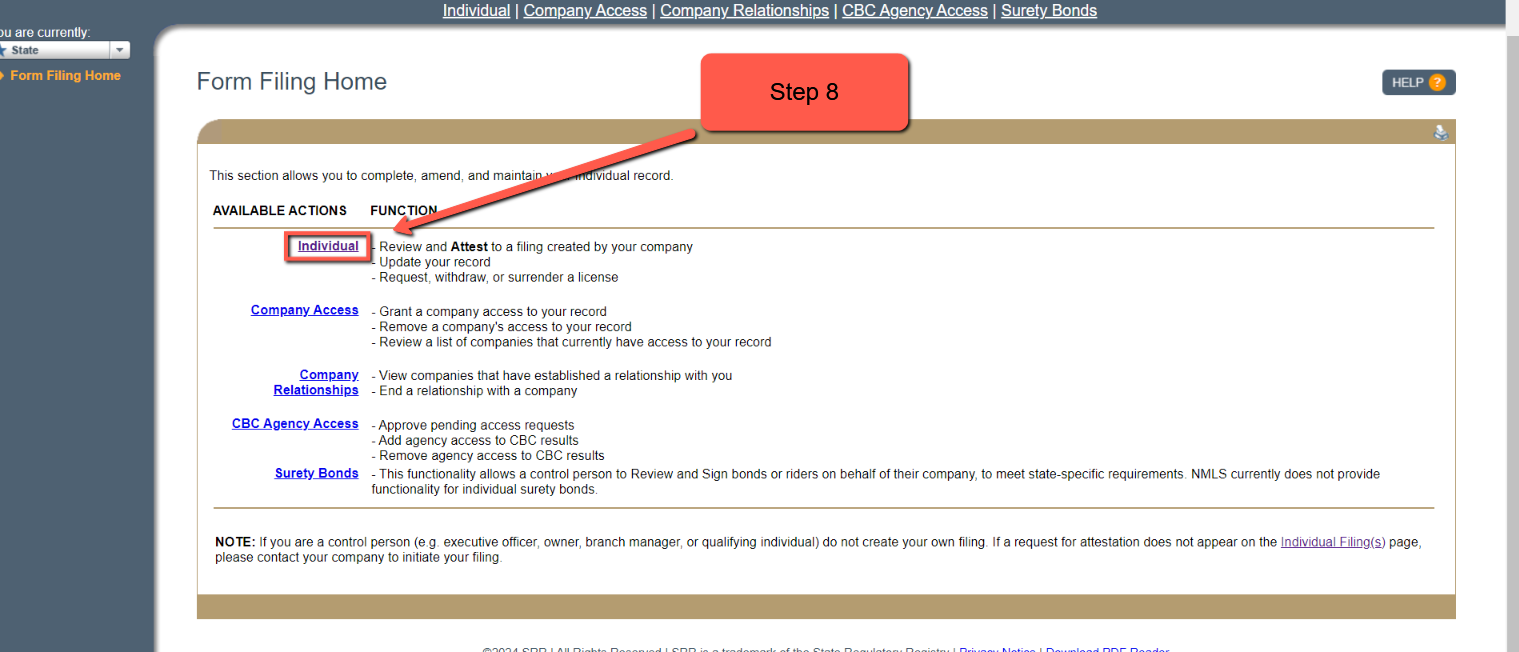

Step 8 – Click on the “Individual” option.

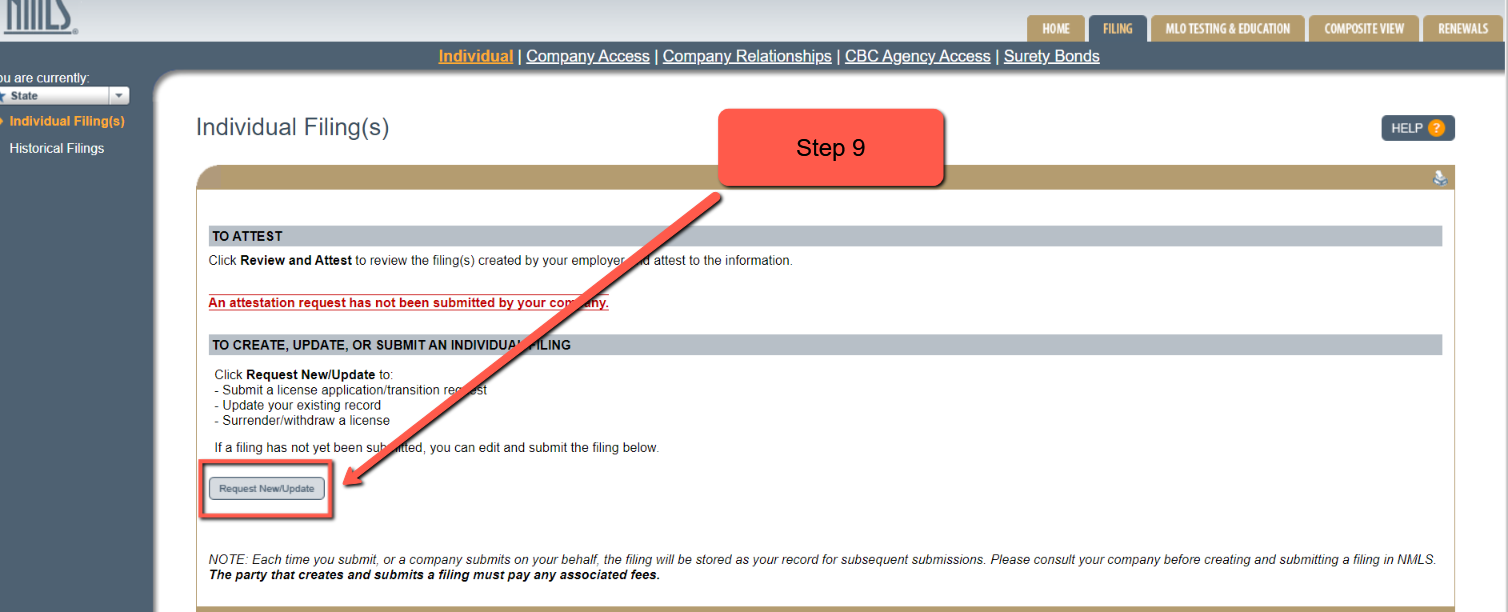

Step 9 – Click on the “Request New/Update” button.

Step 10 – Continue with your individual filing.

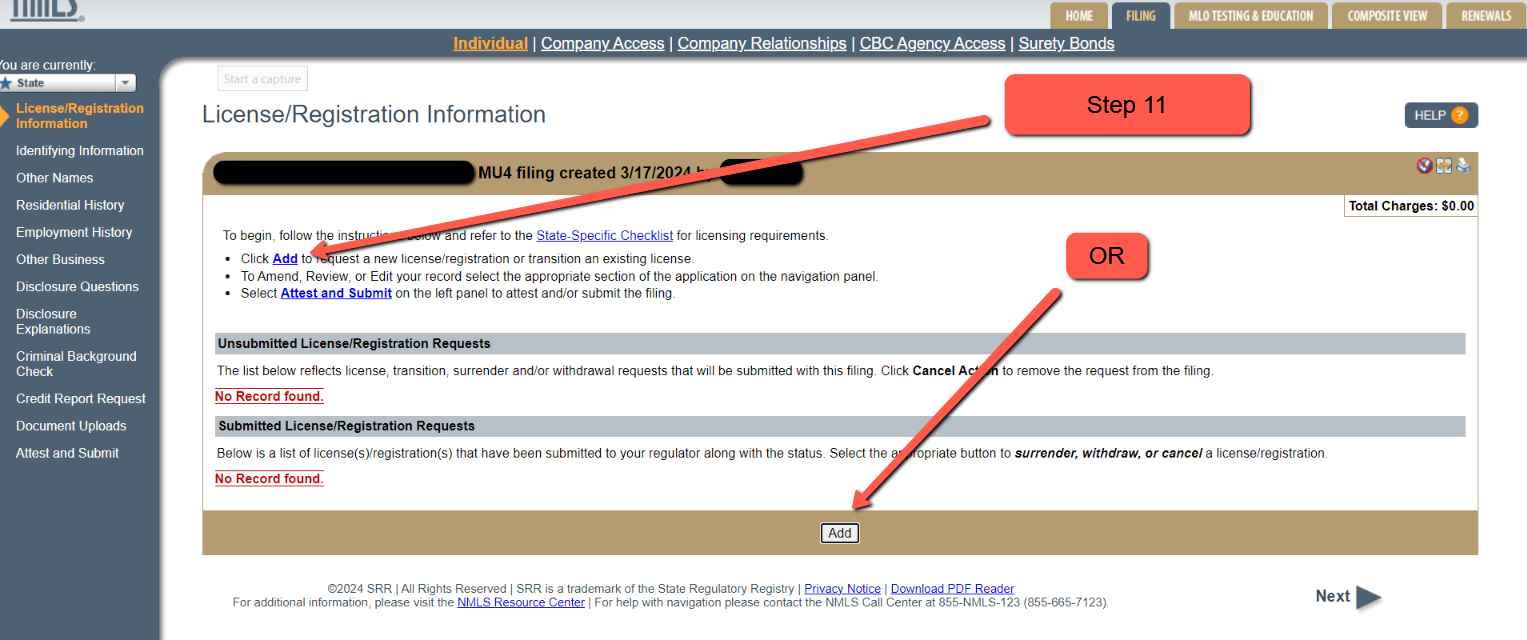

Step 11 – Add your new NMLS Form MU4 Filing Request.

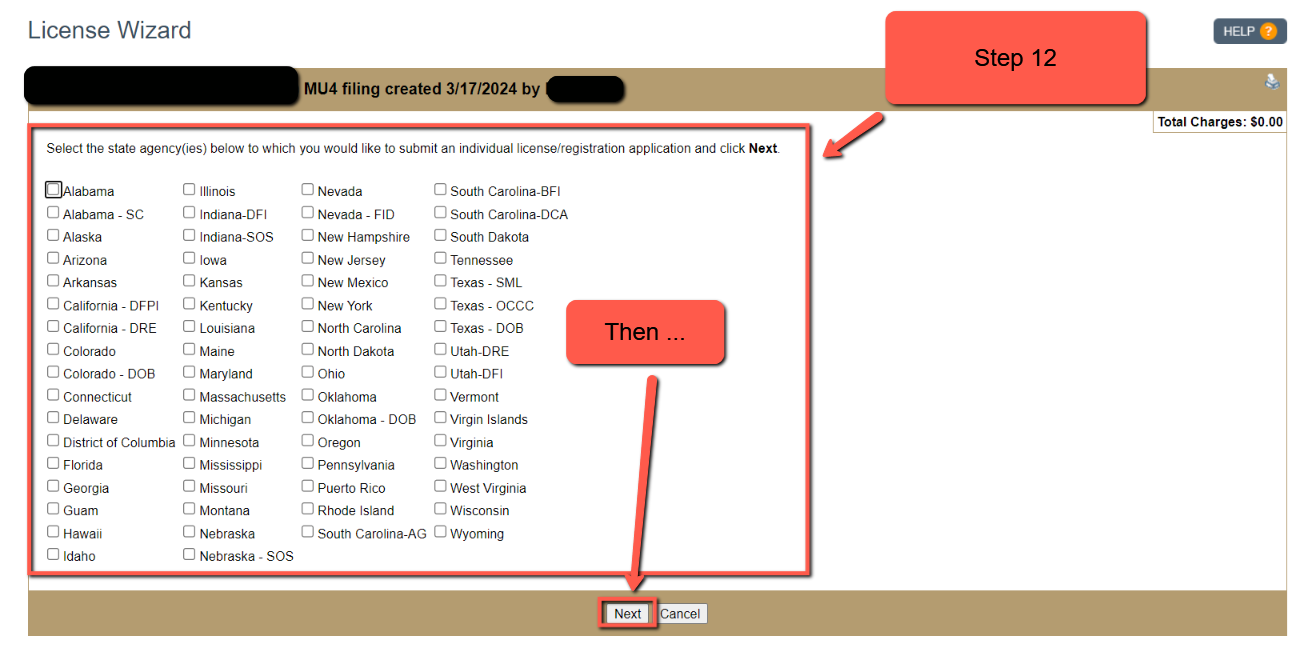

Step 12 – Select the state(s) in which you are seeking licensure.

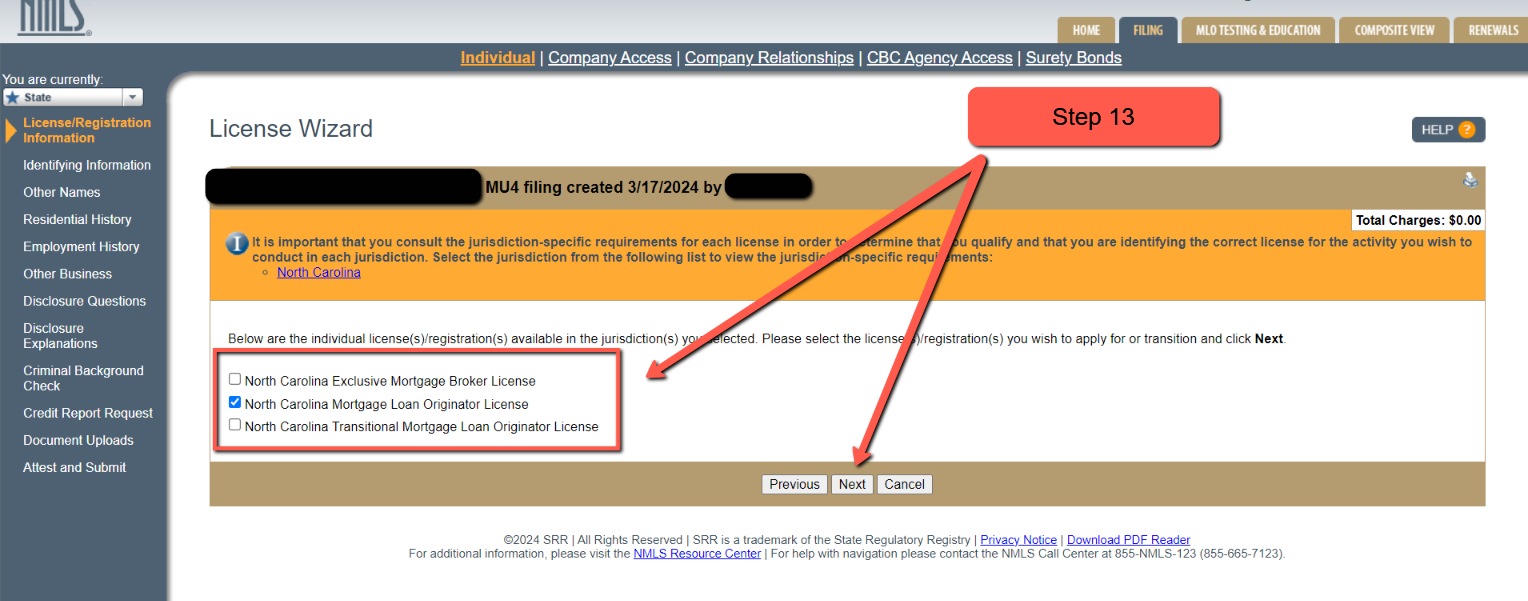

Step 13 – Select the individual license option and then click “Next.”

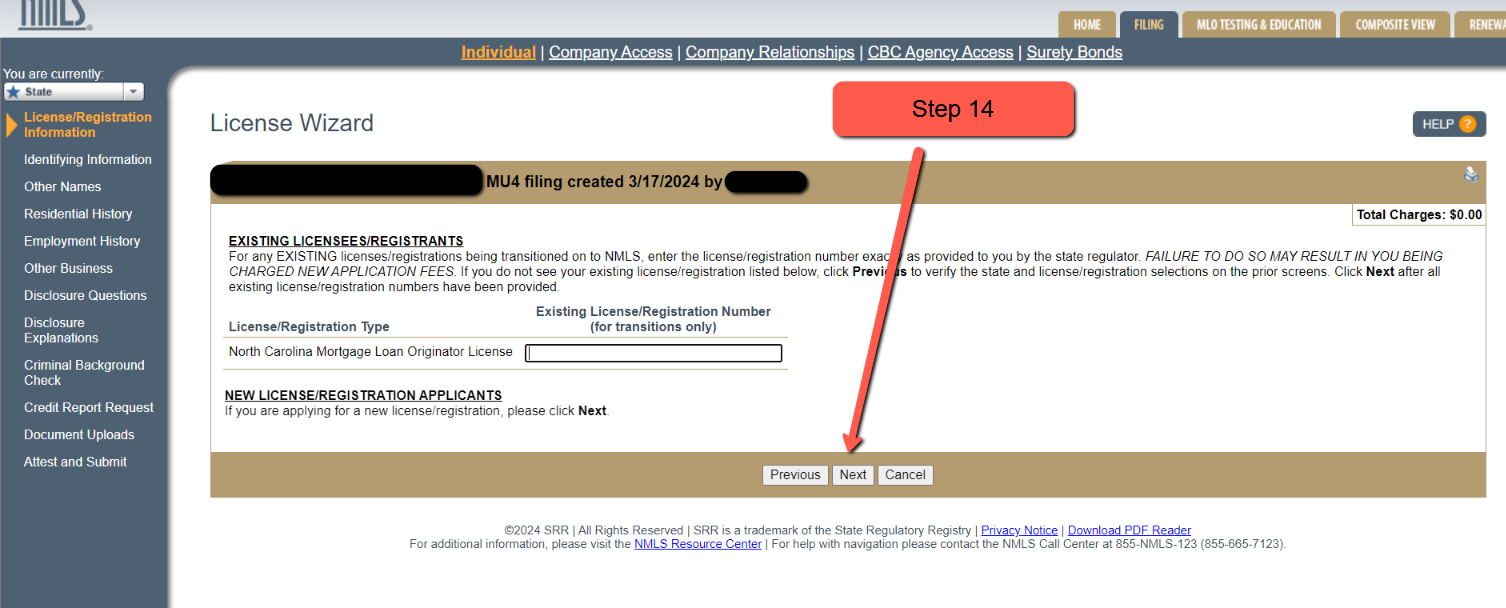

Step 14 – Click on the “Next” button

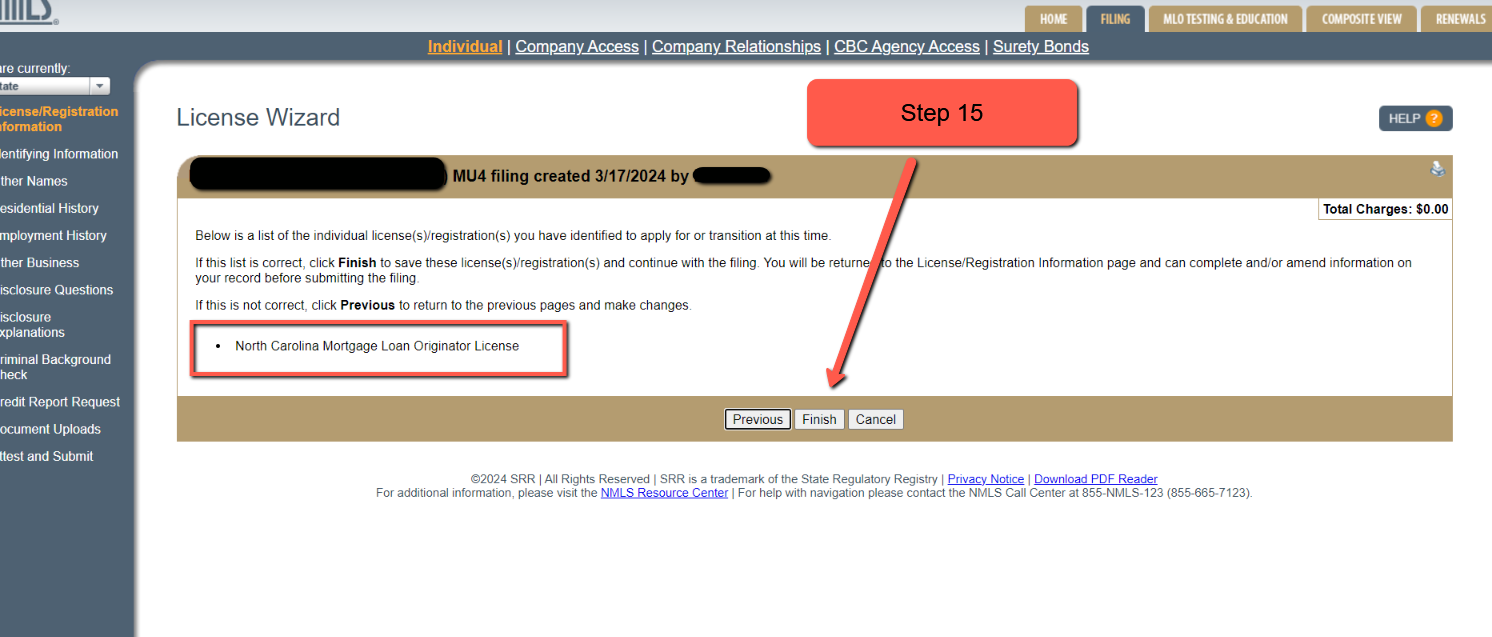

Step 15 – Confirm and finish.

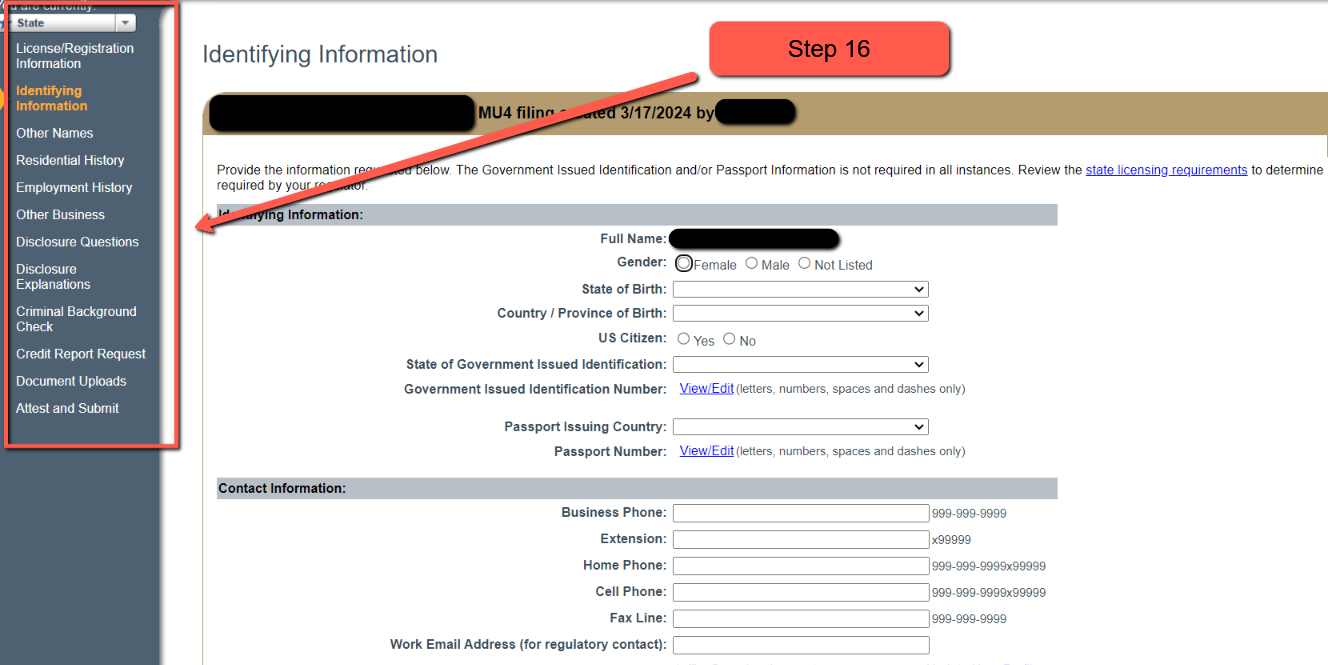

Step 16 – Finalize your MLO application by:

- Thoroughly progressing through and accurately completing all remaining sections (BE CERTAIN TO CLICK ON “SAVE” AT THE BOTTOM OF EACH PAGE BEFORE PROGRESSING TO THE NEXT);

- Providing any explanations (especially detailed explanations pertaining to any derogatory credit issue(s) by independently explaining, for each individual derogatory issue, what happened, why it happened, how you have resolved it or how you are in the process of resolving the issue, and what you have done or are doing to prevent such issues from repeating);

- Authorizing your criminal background check and fingerprints;

- Authorizing your credit report review;

- Uploading any and all applicable documents;

- Attesting, under oath, to the accuracy of the information that you’ve provided; and

- Remitting your non-refundable application, criminal background, and credit report fees.

Step 17 – Wait for the decision. Be certain to check your NMLS account and e-mail regularly (including your spam/junk folder). If anything additional is needed, the NMLS will post whatever is needed to your NMLS account page. If you do not provide the needed material within their established timeframe, your application will be withdrawn and all fees that you paid will be forfeited.

Assuming that your MLO application(s) is/are approved, you will receive it/them within the timeframe established by each individual state or U.S. possession. Turnaround times vary from one-to-two weeks to one-to-three months depending on the state/possession, the time of year, and the number of applications on which that state/possession is currently processing.

IMPORTANT MISCELLANEOUS INFORMATION

In general, if your MLO license is issued between November 1st and December 31st, it will be valid through December 31st of the following year. If it is issued prior to November 1st, your license will expire on December 31st of that year. To continue originating mortgage loans, licensed mortgage loan originators are required to renew their licenses annually by:

- Completing an 8-hour, NMLS-approved, national continuing education course;

- Completing any NMLS-approved state-specific continuing education required by the state(s) in which the licensee is licensed; and

- Applying for renewal which includes remitting the annual license renewal fee.

Any state-licensed mortgage loan originator who has neglected to renew his or her MLO license by 11:59 p.m. on December 31st must cease and desist from all mortgage loan origination activities that would otherwise require licensure until an active MLO license has once again been secured.

All NMLS-approved national and state-specific continuing education courses may be obtained through OnlineEd (NMLS #1400327) the premier NMLS-approved education provider (save 10% off of the already-low registration fee by using coupon code success10 when registering).

Please feel free to reach out to us with any other questions that you might have via info@axsdevelopment.com. We’re always thrilled to hear from and assist new and aspiring mortgage professionals achieve success.

Good luck!

Rich